Fairfax India to Provide $200 Million Liquidity Support to IIFL Finance Following RBI’s Gold Loan Sanction

In a significant development, IIFL Finance announced that Fairfax India, its shareholder, has committed to providing up to $200 million in liquidity support. This decision comes in the wake of the Reserve Bank of India (RBI) imposing a ban on IIFL Finance, preventing the company from sanctioning and disbursing gold loans due to supervisory concerns. The RBI’s action highlighted serious issues in the company’s processes for assaying and certifying the purity of gold, leading to a sharp 36% decline in IIFL Finance shares over the last two trading sessions.

Responding to the liquidity concerns raised by investors and lenders following the RBI’s embargo, IIFL Finance disclosed Fairfax India’s willingness to offer financial assistance. The terms of this support are to be mutually agreed upon and will adhere to all applicable laws, including any necessary regulatory approvals. This move underscores Fairfax India’s confidence in IIFL Finance’s management team, emphasizing their trust and long-term investment in the IIFL group of companies.

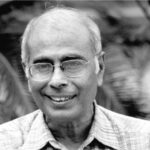

Prem Watsa, Chairman of Fairfax India, expressed his faith in IIFL’s management, particularly in Nirmal Jain and R Venkataraman, to take corrective actions that will align with the RBI’s compliance standards. On his part, Nirmal Jain, Managing Director and Founder of IIFL Finance, appreciated the timely and motivating support from Fairfax India, reiterating the company’s commitment to adhere to the RBI’s directives and focus on compliance, risk management, and fair practices to steer the business forward.

Pic Courtesy: google/ images are subject to copyright