RBI Holds Interest Rates Steady Amid Inflation Targets and Growth Projections

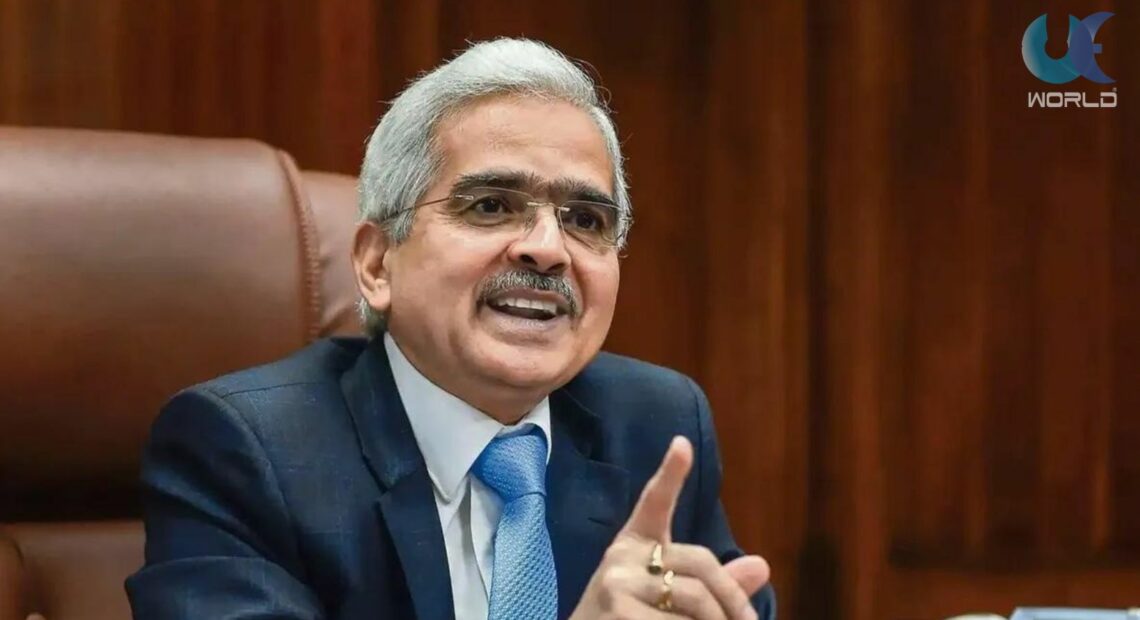

In a move that maintains the status quo, the Reserve Bank of India (RBI) has once again held its key lending rate, the repo rate, at 6.5%. This decision, announced during the bi-monthly Monetary Policy Committee (MPC) meeting, marks the seventh consecutive time the rate has remained unchanged. RBI Governor Shaktikanta Das noted that the committee, by a majority of 5:1, opted for steadiness, influenced by the gradual movement of inflation towards the set targets and acknowledging robust growth prospects for the nation.

Governor Das highlighted the central bank’s success in steering inflation closer to its goal, projecting a retail inflation rate of 4.5% for the current year. With core inflation showing a steady decline over the past nine months and fuel prices experiencing a sustained period of deflation, the RBI remains focused on its mandate to keep retail inflation within a 2% margin of its 4% target. Despite these positive trends, uncertainties, particularly in food prices, continue to challenge the disinflation process, warranting vigilant oversight from the MPC.

Amidst this backdrop of monetary stability, the RBI Governor projected an optimistic growth rate of 7% for the current financial year, underscoring the Indian economy’s resilience. With the rupee displaying remarkable stability against major currencies and the country’s foreign exchange reserves hitting record highs, India’s economic landscape appears robust. The central bank’s steady hand in navigating through economic uncertainties underscores its commitment to fostering a stable and growth-oriented economic environment.

Pic Courtesy: google/ images are subject to copyright